This financial calculator determines the loss of real purchasing power from inflation. Usage instructions and explanations of the economics of inflation follow after the calculation form.

Usage Instructions for the Inflation Calculator Form

Please fill the inflation calculator form with an amount of money available today, the inflation rate and the number of years you would like to wait until spending the money. All fields above the calculate button are input values that you can adjust to your needs. From these inputs the form will calculate the future purchasing power of the amount.

As a second output, the form produces the future dollar value. This is the purchasing power of one dollar after the number of years specified in the form have passed.

Furthermore, in its details section the computation produces the future purchasing power in annual increments. Since this list can grow quite long, you can hide it by clicking on the “hide -” label in its upper right corner.

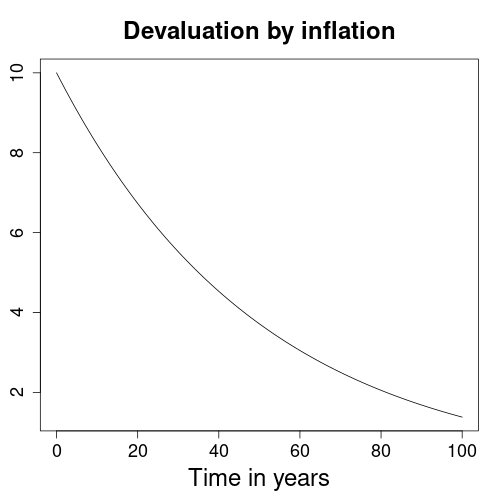

The above image is an example for the loss of purchasing power of $10 over a time-span of 100 years with 2% annual inflation.

Economics of Inflation

Usually, central banks compile a Consumer Price Index (CPI) to measure inflation. Alternatively, a Producer Price Index (PPI) focuses on what producers of consumer goods pay for their input products. Both CPI and PPI are weighted averages of baskets of key goods and services. Therefore, inflation estimates depend on what goods and services central banks consider key consumer items or producer inputs. It can be surprising what kinds of elementary goods, such as housing, don’t enter the CPI! And for those goods and services that are part of the index the weights may be changing.

Take cell phones as an example of a changing consumer good. In the 1990s, they were really just phones with an additional capability for sending text messages. Now, they are general purpose hand-held and networked computers with an integrated phone. Moreover, their changing functions are becoming ever more powerful. Just consider the growing camera resolutions in megapixels, CPU speed and memory sizes. In the CPI, smart phones are increasingly replacing desktop computers, thus changing weights of goods. And in terms of functionality for money, they become cheaper. Actually, my phones are relatively constant in price or even get more expensive. But monetary bankers argue they in fact become cheaper as they can now do so much more. Such views then lower inflation estimates.

Inflation is Politics

Inflation is politics and, I’m afraid, politics is inflation. Sometime in the 1990s, monetary policy shifted towards targeting an inflation rate of around 2% as price stability. In the ECB’s justification, 2% Harmonized Consumer Price Index (HCPI) inflation averts deflation risks and offsets a positive HCPI bias. One argument for the CPI bias is technological progress increasing the effective purchasing power for many consumer goods. Because the HCPI or CPI fails to capture increased utility from improved products, it’s deemed to be upward biased or overestimating inflation. Whether this really compensates for the exponential decline shown in the devaluation graph is a matter of political opinion. After all, in roughly 35 years your dollar will only be worth 50 cents and buy only half the amount of essentials like food, than what you would get today.

The Taylor Rule of Monetary Economics

The Taylor Rule is an instrument of monetary economics for targeting inflation and an optimal state of the economy. According to the Taylor Rule, both an inflation rate above inflation target and an economy running hot should increase interest rates. Following this rule, policy rates should have been negative during much of the 2010s, which justified near zero rates during the past decade. However, as of June 2022, we are experiencing a period of high inflation in the range of 8% in both the EU and the US. And as of yet, policy rates remain well below 1% even though the Taylor Rule suggests values of above 5%. It remains to be seen whether politics has the will to fight inflation. More probably, prices will keep rising quickly for many years to come.

Mathematical Formula for Inflation

The inflation calculator uses the following formula to compute the decline in purchasing power from inflation:

P(t) = P0 * (1 + i)-t

P(t): purchasing power at time t

P0: purchasing power as of today (at t=0)

i: annual inflation rate

t: time in yearsReferences

Two Per Cent Inflation Target: European Central Bank (ECB)

Taylor Rule: Wikipedia.org

FRED Economic Data for the Taylor Rule: St. Louis FED

Similar Computations

Inflation calculator in German: zinseszins.de